Evaluate Suppliers

If you're importing from overseas, we'll help you find high quality suppliers. Our shipping records reveal customers, product lines, and exporting volumes for factories around the world.

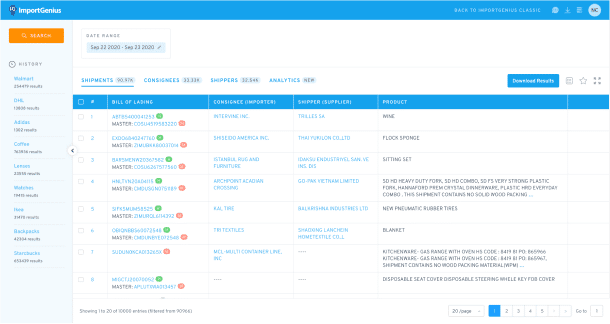

Search global 极速 赛车 168开奖 历史记录 168极速赛车 开奖1分钟 import/export records from US Customs at the bill of lading level for 8 million businesses.

No commitment, cancel anytime.

ImportGenius has complete trade data for 18 countries including the US, India, Russia and most of Latin America

ImportGenius tracks shipping activity around the world to show you exactly what’s happening in the import-export business. There’s no better way to identify suppliers, connect with new customers, and learn about your competitors' supply chains.

See how ImportGenius helps you grasp these opportunities and use them to their maximum potential.

We provide for a diverse client base that requires keen insight into international trade. Our customers include some of the world's top importers, exporters, freight forwarders and more.

“We find new clients for our customs brokerage in the ImportGenius database almost every day.”